aqsipos.ru

Market

What Is A Netspend Mastercard

The Western Union® NetSpend® Prepaid MasterCard® is an international prepaid debit card with the power to send and receive money transfers and direct. Add Money To Your Account. Direct Deposit. No Fee. Page 1 of 4. What It Costs | NetSpend Prepaid Debit Cards. 4/5/ aqsipos.ru Netspend offers consumers a prepaid Visa or Mastercard account as a checking account alternative. Without any credit checks or upfront fees. The Netspend Prepaid Mastercard is issued by Pathward®, National Association, Member FDIC, pursuant to license by Mastercard International Incorporated. and may be used everywhere Visa debit cards are accepted, and pursuant to license by Mastercard International Incorporated, respectively. Please see back of. Get a NetSpend Visa or MasterCard prepaid debit card for the smartest way to pay & get paid. No credit check, no hidden fees, and no surprises. The Netspend® Debit Account is a deposit account established by Pathward, N.A. Please see the back of your Card for its issuing bank. Ouro Global, Inc. is a. Find out all about the NetSpend Visa Prepaid Card - we'll provide you with the latest information and tell you everything you need to know to find your. With the Western Union® Netspend® Prepaid Mastercard® you can pay bills like rent, mortgage, cable TV, Internet, natural gas, electricity, insurance, auto. The Western Union® NetSpend® Prepaid MasterCard® is an international prepaid debit card with the power to send and receive money transfers and direct. Add Money To Your Account. Direct Deposit. No Fee. Page 1 of 4. What It Costs | NetSpend Prepaid Debit Cards. 4/5/ aqsipos.ru Netspend offers consumers a prepaid Visa or Mastercard account as a checking account alternative. Without any credit checks or upfront fees. The Netspend Prepaid Mastercard is issued by Pathward®, National Association, Member FDIC, pursuant to license by Mastercard International Incorporated. and may be used everywhere Visa debit cards are accepted, and pursuant to license by Mastercard International Incorporated, respectively. Please see back of. Get a NetSpend Visa or MasterCard prepaid debit card for the smartest way to pay & get paid. No credit check, no hidden fees, and no surprises. The Netspend® Debit Account is a deposit account established by Pathward, N.A. Please see the back of your Card for its issuing bank. Ouro Global, Inc. is a. Find out all about the NetSpend Visa Prepaid Card - we'll provide you with the latest information and tell you everything you need to know to find your. With the Western Union® Netspend® Prepaid Mastercard® you can pay bills like rent, mortgage, cable TV, Internet, natural gas, electricity, insurance, auto.

NetSpend Visa Prepaid Card. Apply now on NetSpend's secure website. Review featured cards from our partners below. The Netspend Card is a prepaid debit card that can be used for a variety of purposes, such as making purchases, paying bills, and withdrawing cash. Prepaid Debit Cards- An Advance Financial NetSpend Debit MasterCard and NetSpend Debit Visa Prepaid Card can be used anywhere Visa or MasterCard are. Do Netspend Cards Come with Money on Them? No, Netspend cards do not come preloaded with money. They need to be funded before they can be used. Get paid up to 2 days faster4 with direct deposit. Get your paycheck or government benefits up to 2 days faster with direct deposit. The NetSpend Prepaid debit card gives you a debit card that you can use to make purchases at stores and online, even if you don't have a checking account. 1 Netspend Prepaid Customers: Faster funding claim is based on a comparison of our policy of making funds available upon receipt of payment instruction. Combine the power of a Netspend® prepaid card with Western Union® worldwide money transfer.2 Card usage is subject to card activation and identity verification. The Brink's Money Prepaid Mastercard® combines the security of Brink's with the flexibility and power of Netspend. By signing up for a Brink's Money Prepaid. It's a trick, a scam. The card is designed to make you think you have a credit card, but it means nothing unless you sign up for their “service”. Netspend is a company with prepaid cards that offers an alternative to checking account debit cards, credit cards, and cash. · Netspend makes its money through a. Get a Netspend Prepaid Mastercard. The card that lets you manage your money the smart way. No Credit Check 1. No Minimum Balance Required. Prepaid cards by Mastercard provide more convenient, safer & smarter options to pay than cash. Get Mastercard reloadable prepaid cards for secure payments. *Use of features is subject to card activation and identity verification. More than moving money. The Western Union® Netspend® Prepaid Mastercard® mobile. Use the PayPal Prepaid Mastercard to eat, drink and shop everywhere Debit Mastercard is accepted. Order online and once your information has been verified. The Netspend mobile app lets you manage your Card Account conveniently from your phone. Send and receive money, load checks, find reload locations and more! The Netspend Prepaid Mastercard is issued by Pathward®, National Association, Member FDIC, pursuant to license by Mastercard International Incorporated. 1 Netspend Prepaid Customers: Faster funding claim is based on a comparison of our policy of making funds available upon receipt of payment instruction. With your Netspend Card Account, you are able to generate up to 6 temporary Virtual Account numbers for online and phone transactions. The Netspend® Debit Account is a deposit account established by Pathward, N.A. Please see the back of your Card for its issuing bank. Ouro Global, Inc. is a.

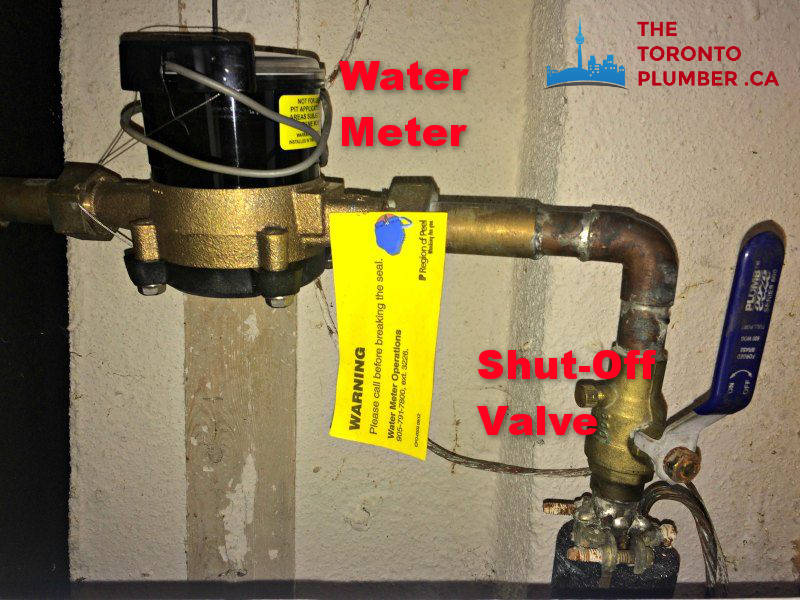

Water Shut Off Valve Apartment Building

Cities and Counties that allow condos to be built without an individual shutoff should be ashamed and possibly sued for damages. Systems have valves for a. In two-family dwellings and in dwelling units of buildings classified in occupancy group J-2, control valves on the supply branch or stop valves on each. Looking to shut the water off to replace my laundry valves. I live in a condo and looked around to find the main valve for the water. Didn't. Water shut off valves are the primary connection between the water that travels from your town's supply to your home's plumbing system. In a lot of cases, the. Looking to shut the water off to replace my laundry valves. I live in a condo and looked around to find the main valve for the water. Knowing where to find the shut-off valve in your house can save you from a potential flood fiasco if a water pipe bursts. In most homes, the main water shut-off. The main water shut off is a valve that shuts off all water coming into your house from the public utility (water company), or private supply (your well). Customers should generally shut off their water with their home valves. If your home does not have a water shut-off valve, we highly recommend that you contact. shutting off the valve at the water heater will stop the hot side flow but not the cold. It's very common for apartments not to have their own water main (cold). Cities and Counties that allow condos to be built without an individual shutoff should be ashamed and possibly sued for damages. Systems have valves for a. In two-family dwellings and in dwelling units of buildings classified in occupancy group J-2, control valves on the supply branch or stop valves on each. Looking to shut the water off to replace my laundry valves. I live in a condo and looked around to find the main valve for the water. Didn't. Water shut off valves are the primary connection between the water that travels from your town's supply to your home's plumbing system. In a lot of cases, the. Looking to shut the water off to replace my laundry valves. I live in a condo and looked around to find the main valve for the water. Knowing where to find the shut-off valve in your house can save you from a potential flood fiasco if a water pipe bursts. In most homes, the main water shut-off. The main water shut off is a valve that shuts off all water coming into your house from the public utility (water company), or private supply (your well). Customers should generally shut off their water with their home valves. If your home does not have a water shut-off valve, we highly recommend that you contact. shutting off the valve at the water heater will stop the hot side flow but not the cold. It's very common for apartments not to have their own water main (cold).

You should see a ground-level utility box. The box will indicate whether or not you can turn the valve off yourself or if you need to call the water company's. These shut-off valves are great for cutting water flow to a specific place, a necessity for basic plumbing work. You may have used these valves a few times, but. Each apartment has an individual water shutoff. It's usually under one of the sinks or next to the water heater, but it can be anywhere. The most likely location for your house shutoff valve is either at a hose bib in the front or side of your house where the water supply enters your home or in. Homes with basements will likely have their water shut off valve located near the front wall of the home's foundation. Your water supply may come up through the. Homes with basements will likely have their water shut off valve located near the front wall of the home's foundation. Your water supply may come up through the. Before you start, it's a good idea to turn off the water at the main water shutoff valve to prevent a broken water pipe from causing water damage. In our most. A main water valve stops the flow of water from the water meter to the entire house. Other water valve types shut off the water at individual appliances. Knowing where your shut-off valve is located is the best way to help avoid extensive property damage in an emergency. While some buildings have the water meter. It is usually ideal to have a secondary shut-off valve for water pipes in the living space (under a sink or near the water heater). • In crawl spaces without a. By plumbing code, a main shut off valve is also required near where the main water supply comes into the house. This is the valve designed for the homeowner to. There is no legal principle that you need to shut off their water supply. They need to be responsible for that is that is common area property. You probably. The type of water shutoff valve used in your building may not be something you've given a lot of thought to, but it can become important when you least. This shutoff valve can usually be turned off by hand. Just turn the valve handle clockwise to turn off all water to the house. The other valve is located near. to the Private Water Infrastructure Pipe shall have an accessible shut off valve installed no less than 3 feet from the outside of the building wall and in line. It is usually a circular shaped gate valve designed to shut off and turn on slowly, or can be a ball valve with a blue handle that turns off at a 90 degree. A tremendous amount of water is wasted every time the system is drained. A flood in one apartment necessitates shutting down the entire building. When there is. There is usually a valve, knob, or switch on this pipe that turns the water off to your home. Some older houses may have the shut off valve located at the rear. If your home only has a crawlspace, the valve may be there or along the front perimeter wall. Homes built on a slab may have water main shut-off valves near the. The water shut-off valve location will vary depending on the layout of your home or apartment building. In a house, the shut-off valve is usually located near.

Physician Assistant After Mbbs

A Physician Assistant or Physician Associate (PA) is a type of healthcare professional. While these job titles are used internationally, there is. It is not needed that you pursue an MBBS. You can opt for a BSc, Bpharma or any other medical and healthcare-related degree. Que. Is PA equivalent to MBBS? By law, all international medical school graduates who seek to be licensed in California as a physician assistant must: Successfully complete a Board approved. What's the job scope after post graduation??? Are we allowed to Can an IMG doctor work as a Physician's Assistant in. Canada? Is it. The Master of Science in Physician Assistant program employs a comprehensive credit curriculum to instill students' medical knowledge and clinical skills. Physician Assistants (PAs) practice medicine on healthcare teams with physicians and other providers. They practice under a supervising physician. A PA earns a. Unfortunately, in the US, there is no such thing as advanced placement or fast track in healthcare. This includes PA school. You will have to. "Assistant physician", any medical school graduate who: Is after graduation from a medical college or osteopathic medical college, whichever is later;. He must have mistyped. Get it corrected. Physician assistant is a separate Bsc cader with its own degree. A Physician Assistant or Physician Associate (PA) is a type of healthcare professional. While these job titles are used internationally, there is. It is not needed that you pursue an MBBS. You can opt for a BSc, Bpharma or any other medical and healthcare-related degree. Que. Is PA equivalent to MBBS? By law, all international medical school graduates who seek to be licensed in California as a physician assistant must: Successfully complete a Board approved. What's the job scope after post graduation??? Are we allowed to Can an IMG doctor work as a Physician's Assistant in. Canada? Is it. The Master of Science in Physician Assistant program employs a comprehensive credit curriculum to instill students' medical knowledge and clinical skills. Physician Assistants (PAs) practice medicine on healthcare teams with physicians and other providers. They practice under a supervising physician. A PA earns a. Unfortunately, in the US, there is no such thing as advanced placement or fast track in healthcare. This includes PA school. You will have to. "Assistant physician", any medical school graduate who: Is after graduation from a medical college or osteopathic medical college, whichever is later;. He must have mistyped. Get it corrected. Physician assistant is a separate Bsc cader with its own degree.

It is considered a master's degree that will last 2 years (US) or 3 three years (UK), where the standard medical or healthcare-related subjects are taught. PA Profession at a Glance Highly trained and skilled clinicians, Physician Assistants expand access to medical care. PAs are a vital part of the healthcare. Physician assistants (PAs) are nationally certified and licensed medical professionals who work on health care teams with physicians and other providers. Physician Assistant (PA). PAs are highly trained medical professionals who work in collaboration with MDs and DOs. They typically hold a master's degree in. It is recommended that you investigate state and other requirements for PA licensure as you prepare to make application for future admission to a PA program. MD: Medical doctor MDs practice the classical form of medicine called allopathic (conventional) medicine. Making up 90% of today's practicing physicians, MDs. PA Profession at a Glance Highly trained and skilled clinicians, Physician Assistants expand access to medical care. PAs are a vital part of the healthcare. Your experience as a medical assistant may have provided you with the patient care hours required for admission into a PA program. However, if you plan on. Canadian Certified Physician Assistant and Graduate of the University of Toronto Physician Assistant Program Class of Licensed Physician from Bangladesh. The physician assistant program is a graduate program that awards a Master of Physician Assistant Medicine (MPAM) degree. UT's PA Program allows students to. What is a physician assistant (PA)? They are health care professionals who assist doctors and share patient care responsibilities with them. PAs are also. PAs finish their training in around two years, while physicians finish medical school in around four years. After these four years, physicians must go through. However, while doctors go on to complete a four-year curriculum in a medical or osteopathic college, PAs complete a two-year master's degree. While the course. A medical assistant is more of an entry- to-mid level career while as a physician assistant you will assist and perform advanced duties with a practicing. since the first PA Program rankings were published. About the Emory PA Master of Medical Science in Physician Assistant Degree - MMSc-PA · Master of. A physician assistant, or physician associate, is a healthcare professional licensed to practice medicine. PAs are not medical assistants or registered nurses. Dsouza, PA-C, MBBS. Home» Doctors» Mark A. Dsouza, PA-C, MBBS. Mark A. Dsouza, PA-C, MBBS Post Graduate Institute in Chandigarh, India in In Physician Assistants (PA) undergo rigorous didactic medically oriented curriculum, as well as at least one year of clinical rotations to obtain the entry-level. Physician Assistants (PA) are health care professionals licensed to practice medicine with supervision from a doctor of medicine (MD) or doctor of osteopathic. Master of Physician Assistant Studies Program · Master of Physical Therapy The following are represented within the crest: Medicine Wheel 4.

Average Yearly Cost Of A Dog

We multiplied the annual cost by the average life expectancy for small, medium and large dog breeds*. We added this number to the estimated cost of getting. I believe ours sits between $4, to $5, combined annually for both 50+ pound dogs. This includes vet visits, medication, collars, tags. Small dog: $15, (average life expectancy of 15 years); Medium dog: $15, (average life expectancy of 13 years); Large dog: $14, (average life expectancy. On average, you can expect to pay around $ on cat food annually. If your cat requires a special prescription diet due to a chronic medical issue, your. The average new dog owner pays around $1, in ownership expenses, and some residents will pay nearly $3, per year. In just the first year of dog ownership, pet parents pay between $1, and $2, to cover all their puppy's initial costs, according to a news report The monthly and yearly costs of owning a dog encompass various aspects like food, veterinary care, grooming, and supplies. On average, monthly. Given you spend the average of $50 a month for a bag of dog food, you should budget for around $ a year. Quality dog foods on the other hand can range from. After covering the initial expenses to make your home dog-ready, keep the on-going, annual costs in mind. Our research shows that the average dog owner may. We multiplied the annual cost by the average life expectancy for small, medium and large dog breeds*. We added this number to the estimated cost of getting. I believe ours sits between $4, to $5, combined annually for both 50+ pound dogs. This includes vet visits, medication, collars, tags. Small dog: $15, (average life expectancy of 15 years); Medium dog: $15, (average life expectancy of 13 years); Large dog: $14, (average life expectancy. On average, you can expect to pay around $ on cat food annually. If your cat requires a special prescription diet due to a chronic medical issue, your. The average new dog owner pays around $1, in ownership expenses, and some residents will pay nearly $3, per year. In just the first year of dog ownership, pet parents pay between $1, and $2, to cover all their puppy's initial costs, according to a news report The monthly and yearly costs of owning a dog encompass various aspects like food, veterinary care, grooming, and supplies. On average, monthly. Given you spend the average of $50 a month for a bag of dog food, you should budget for around $ a year. Quality dog foods on the other hand can range from. After covering the initial expenses to make your home dog-ready, keep the on-going, annual costs in mind. Our research shows that the average dog owner may.

The national average cost for a routine vet visit is between $$ During a routine veterinary appointment, your vet will perform a physical exam to. However, if we assume the average dog lives ten years and costs around $2, a year with an initial upfront cost of $3, in the first year, the cost of a dog. The annual costs of caring for a dog can range from $1,–$5, a year, while the typical monthly cost of owning a dog lies between $$ This is an. The cost of owning a dog can be estimated between $ to $ per year. Financially providing for your dogs is a big part of being a responsible dog owner. It may be easier to budget for a dog by the month, which is an estimated $ for small dogs, $ for medium pups, and $ for large ones.* These. On average, basic expenses include food, veterinary care, grooming, and supplies, totaling approximately $1, to $2, annually. Just like humans, pets should get annual vet check-ups with a doctor you trust. These visits keep your pet safe and help alert you, early, if something is wrong. Average Monthly Pet Insurance Premiums (US), Year-Over-Year ; , $, $ ; , $, $ ; , $, $ ; , $, $ How Much is Pet Insurance? · Cat owners pay an average of $ per year or $ per month, based on NAPHIA data. Cat insurance costs less because their care. Average Premiums (U.S.) ; DOG, Annual: $ Monthly $, Annual: $ Monthly $ ; CAT, Annual: $ Monthly $, Annual: $ But in terms of the necessities, you can expect the cost of a dog or puppy to start at a minimum of $ in the first year, and continue to cost at least $ Given you spend the average of $50 a month for a bag of dog food, you should budget for around $ a year. Quality dog foods on the other hand can range from. Cost of owning a pet. Cats and dogs are a big personal and financial commitment. In the first year, a cat or dog will cost you between $3, and $6, Average cost of dog insurance ; Average annual costN/A ; Fixed annual cost/range$$ per year **Read the associated disclosure for this claim. ($$ The average cost of dog insurance is $ per month, according to premium quotes analyzed by Investopedia. However, premium costs depend on the plan type. We multiplied the annual cost by the average life expectancy for small, medium and large dog breeds*. We added this number to the estimated cost of getting. The total number of pets insured in the U.S. at year-end was nearly million, a 17 percent increase over The average accident and illness premium. Dogs can live for up to 20 years. So on top of the initial costs during his first year, you may also be looking at an additional $ per year minimum for the. Average Vet Costs for the First Year of Owning a Dog or Cat The APSCA estimates that the first year of owning a dog can cost as much as $2, or more. "How much do dogs cost per year? According to the ASPCA, the average pet owner spends nearly $1, annually on their furry pal. However, other sources put.

What Is The Mortgagee

Under the title theory, title to the security interest rests with the mortgagee. Most states, however, follow the lien theory under which the legal title. The mortgagee clause is included in a property insurance policy to make sure the insurance company will pay the mortgagee -- also known as the lender -- if. The Bottom Line: A Mortgagee Lends Money To The Mortgagor A mortgagee is simply the entity that makes the home loan, while a mortgagor is the person or persons. The mortgagee clause is a provision included in the insurance policy associated with the mortgaged property. It protects the interests of the mortgagee by. The meaning of MORTGAGE is a conveyance of or lien against property (as for securing a loan) that becomes void upon payment or performance according to. A mortgage in itself is not a debt, it is the lender's security for a debt. It is a transfer of an interest in land (or the equivalent) from the owner to the. A mortgagee is an individual or entity that lends money to a borrower for the purchase of real estate. In short, the mortgagee is the lender. A mortgagee is a lender who provides money to the owner of real estate and who takes security or a lien in real estate as assurance for repayment of the. An individual or entity (such as a bank) that provides a loan that is secured by a mortgage against real property, also known as a lender. Under the title theory, title to the security interest rests with the mortgagee. Most states, however, follow the lien theory under which the legal title. The mortgagee clause is included in a property insurance policy to make sure the insurance company will pay the mortgagee -- also known as the lender -- if. The Bottom Line: A Mortgagee Lends Money To The Mortgagor A mortgagee is simply the entity that makes the home loan, while a mortgagor is the person or persons. The mortgagee clause is a provision included in the insurance policy associated with the mortgaged property. It protects the interests of the mortgagee by. The meaning of MORTGAGE is a conveyance of or lien against property (as for securing a loan) that becomes void upon payment or performance according to. A mortgage in itself is not a debt, it is the lender's security for a debt. It is a transfer of an interest in land (or the equivalent) from the owner to the. A mortgagee is an individual or entity that lends money to a borrower for the purchase of real estate. In short, the mortgagee is the lender. A mortgagee is a lender who provides money to the owner of real estate and who takes security or a lien in real estate as assurance for repayment of the. An individual or entity (such as a bank) that provides a loan that is secured by a mortgage against real property, also known as a lender.

A mortgagee is a financial institution that is the lender in a mortgage, holding a financial interest in the property. Mortgagee definition: a person to whom property is mortgaged.. See examples of MORTGAGEE used in a sentence. Mortgagee. Related Content. An individual or entity (such as a bank) that provides a loan that is secured by a mortgage against real property, also known as a. An adjustable rate mortgage (ARM) is a type of loan for which the interest rate can change, usually in relation to an index interest rate. noun mort· gag· ee ˌmȯr-gi-ˈjē: a person to whom property is mortgaged Examples of mortgagee in a Sentence. A mortgagee is an individual or entity, such as a bank or mortgage company, that lends money to a borrower for the purchase of property. The mortgagee clause gives your homeowners insurance company the right to pay your lender in certain circumstances. Learn more about them. The three main clauses are mortgagee, loss payee, and lender's loss payee – but what do they all mean and when does each apply? Examples of Mortgagee · Example 1: Investment banks · Example 2: Credit unions. Here's Investopedia's definition of a Mortgagee. How ContractsCounsel Works. A Mortgagee Clause is a component of your homeowner's insurance which protects the lender in the event of loss or damage to your property. Learn more! The Bottom Line. A mortgagee clause is a part of your homeowners insurance policy that protects your lender (the mortgagee) from losses incurred due to damage. MORTGAGEE meaning: 1. a bank or similar organization that gives mortgages to people, especially so that they can buy a. Learn more. A mortgagee clause is a property insurance provision granting special protection for the interest of a mortgagee (e.g., financial institution that has an. A mortgagee clause typically is a provision included in a property insurance policy protecting the mortgagee (lender) from financial loss in the event mortgaged. What Is a Mortgagee? A mortgagee is a financial entity that lends money to people or companies looking to purchase real estate using a mortgage. That entity. This topic contains information on the mortgagee clause, named insured, and notice of cancellation requirements. Chase's Mortgage Dictionary defines important terms around mortgages, refinances, home equity, and more! Learn more about homebuying and homeownership here. A mortgagee is an individual or entity that lends money to a borrower for the purchase of real estate. In short, the mortgagee is the lender. 2 meanings: law 1. the party to a mortgage who makes the loan 2. a person who holds mortgaged property as security for. Click for more definitions.

Human Resource Meaning

Human Resources or HR is a set of people or the department that creates the workforce and takes care of people functions in a company. HR is responsible for. Human Resource Management more commonly known as HR has been defined in many different ways but at the heart of every definition is the. Human Resources (HR) focuses on managing an organization's most valuable asset: its employees. HR professionals ensure employees have the necessary resources. Human Resource Management is the process of recruiting, selecting, inducting employees, providing orientation, imparting training and development. Human resources managers plan, coordinate, and direct the administrative functions of an organization. Work Environment. Human resources managers are employed. Human resource planning (HRP) is the continuous process of systematic planning to achieve optimum use of an organization's employees. Human resource management is the strategic approach to nurturing and supporting employees and ensuring a positive workplace environment. Its functions vary. Human resource management (HRM) is the strategic and coherent approach to the effective and efficient management of people in a company or organization such. Human Resources is the department in a company that handles everything related to its employees. It has a wide array of responsibilities, from leading the. Human Resources or HR is a set of people or the department that creates the workforce and takes care of people functions in a company. HR is responsible for. Human Resource Management more commonly known as HR has been defined in many different ways but at the heart of every definition is the. Human Resources (HR) focuses on managing an organization's most valuable asset: its employees. HR professionals ensure employees have the necessary resources. Human Resource Management is the process of recruiting, selecting, inducting employees, providing orientation, imparting training and development. Human resources managers plan, coordinate, and direct the administrative functions of an organization. Work Environment. Human resources managers are employed. Human resource planning (HRP) is the continuous process of systematic planning to achieve optimum use of an organization's employees. Human resource management is the strategic approach to nurturing and supporting employees and ensuring a positive workplace environment. Its functions vary. Human resource management (HRM) is the strategic and coherent approach to the effective and efficient management of people in a company or organization such. Human Resources is the department in a company that handles everything related to its employees. It has a wide array of responsibilities, from leading the.

Human resource management is the process of employing people, training them, compensating them, developing policies relating to the workplace, and developing. What does human resources do? Ask any employee what an HR department is, and you'll get an answer that primarily deals with the most uncomfortable aspects of. It includes activities focusing on the effective use of human resources in an organization. It is concerned with thedevelopment of a highly motivated and smooth. Human Resource Management (HRM) is the process of managing people in organizations in a structured and thorough manner. HR manager is responsible for. the department in a company that is responsible for dealing with employees, for example by employing them, training them, dealing with their problems, and. A head count of zero means that a position is vacant. Hiring Supervisor | AKA Hiring Manager. The supervisor of the position. HR Rep | The Human Resources. When we talk about human resources in a business situation it means the workforce, i.e., the employees of a company and what skills and energy they bring. Human resources is used to describe both the people who work for a company or organization and the department responsible for managing all matters related. The human resources (HR) department's primary job is to manage the employee life cycle and ensure the company's employees are appropriately compensated and. A human resource is any person who is compensated for supplying skills or knowledge to help an organization achieve its business goals. Compared to other. Human resource management (HRM) is the practice of recruiting, hiring, deploying and managing an organization's employees. HRM is often referred to simply. Human resource management (HRM) encompasses the tasks and processes involved in managing and retaining employees. Learn why it's important and how it works. Human Resources is the branch of a business or company that focuses on employee services. The purpose of human resources is to manage the employee life cycle. Human Resource Management (HRM) is a strategic approach to managing employees to achieve better organizational performance. It aims to attract, manage, and. Human resource management is the process of employing people, training them, compensating them, developing policies relating to the workplace, and developing. The human resource definition, broadly stated, is a system to manage the effective use of employee resources within an organization. Human Resource Management (HRM) is the process of managing people within an organization strategically and coherently. It encompasses all the activities. Human resource development (HRD). HRD refers to the training and development of an organization's workforce. It is part of human resource management. Training. Human resources (HR) is the division of an organization that is responsible for recruiting, screening, hiring, and training new employees, as well as. Human resource development (HRD) is defined as the cultivation of an organization's employees. It entails providing workers with skills and relevant knowledge.